Outsourcing Payroll: Maximize Efficiency And Minimize Expenses

페이지 정보

본문

✔ Outsourcing payroll might lower administrative burdens, conserve time, and make sure compliance with tax laws.

✔ Cost savings range from 18%-35% on typical compared to internal payroll processing.

✔ Payroll providers deal with wage estimations, tax filings, direct deposits, benefits deductions, and more.

✔ Businesses of all sizes advantage, especially those without dedicated payroll staff.

✔ Choosing the best payroll service depends upon business size, complexity, and need for combination with existing systems.

Every other Friday, Lisa braced herself for what had essentially end up being a consistent source of tension: payroll. As the office supervisor for a growing home services business, she used numerous hats: scheduling jobs, managing billings, handling HR jobs, and more. Payroll was just another responsibility on her overflowing plate, and regardless of her best shots, something constantly seemed to fail.

Last pay period, she overestimated overtime for 2 service technicians, resulting in a payroll correction that took hours to fix. The month in the past, a tax filing due date slipped through the fractures, leading to an expensive late fee. And after that there were the consistent concerns from staff members about their incomes - was my perk included? Why are my deductions various today? Exists still time to fix my punch card? When will I get my W-2?

Lisa's tension level was through the roofing. Something had to change. Accordingly, Lisa started exploring her choices. What if the company had somebody else deal with payroll? By handing off payroll to an expert provider, or, at the minimum, updating their software, she might eliminate the threat of errors, guarantee compliance with tax laws, and maximize hours each week to focus on running business.

Does your payroll journey mimic Lisa's? Is payroll a barrier that looms at the end of every other week? Luckily, you're not alone. In this short article, we'll check out how contracting out payroll works, the benefits it offers, and whether it's the right relocation for your business.

Outsourcing payroll is the practice of handing off payroll-related tasks to a third-party supplier who focuses on processing incomes, taxes, and other compensation-related obligations. Instead of handling payroll manually - or handling numerous software options - businesses can count on professionals to ensure workers are paid properly and on time while remaining compliant with tax laws.

Payroll service providers handle a variety of jobs, including:

✅ Processing staff member earnings and specialist payments;

✅ Calculating and filing payroll taxes;

✅ Managing direct deposits and paper checks;

✅ Handling reductions, garnishments, and advantages contributions; and

✅ Keeping up to date with ever-changing labor laws and tax rates.

Approximately 61% of companies outsource their payroll procedures. The decision to outsource the entire function or section out parts, such as tax filings or direct deposit management, mainly depends upon company size, payroll intricacy, and internal resources.

For larger businesses with workers throughout numerous states, payroll outsourcing can simplify compliance with various tax laws and guidelines. But little and mid-sized services likewise benefit - particularly those without a devoted payroll professional. Given that payroll laws regularly change, outsourcing makes sure businesses remain certified without needing to continuously keep track of updates.

Years ago, it was unheard of for business to delegate payroll to an outdoors provider. But today, advances in payroll technology make contracting out a cost-effective and efficient service. Whether you need full-service payroll support or simply aid with specific tasks, outsourcing can release up valuable time, reduce administrative headaches, and provide entrepreneur peace of mind. Statistics back this up. According to a PwC study, business that outsource their payroll functions experience expense decreases of 18%-35%, on average.

Is contracting out payroll the ideal choice for your company? In the next section, we'll explore the essential advantages and possible disadvantages to help you decide. If not, a best practice may include updating your internal software application. While we're prejudiced, an option like OnTheClock permits you to encapsulate time tracking, scheduling, and payroll in one platform. No more third-party expenses, hold-ups, or errors!

Don't let taxes get you down. Make payroll easy with OnTheClock!

Your hassle-free solution for payroll.

The Benefits of Outsourcing Payroll

Having your personnel complete payroll may appear like a cost-savings procedure; nevertheless, the truth is that it's often time-consuming, complex, and susceptible to pricey errors. Outsourcing payroll uses organizations a structured, safe, and cost-efficient option. Here's how it can benefit your business:

Save Time and Boost Productivity: Payroll isn't practically moving income - it involves tracking hours, computing taxes, managing advantages reductions, and guaranteeing compliance with ever-changing policies. For little organizations, this obligation typically falls on a bachelor or a small HR group, pulling focus far from tactical efforts. Outsourcing payroll removes these time-consuming jobs, releasing up your team to focus on development and staff member engagement.

Reduce Payroll Costs: Many small and mid-sized companies find that contracting out payroll is more cost-effective than keeping an in-house payroll team. The expenditures connected with payroll software, worker training, tax filing, and compliance management can build up rapidly. By contracting out, companies can access professional payroll services at a foreseeable monthly expense - frequently less than the expenditure of hiring a full-time payroll specialist.

Minimize Errors and Ensure Compliance: Payroll mistakes aren't simply discouraging - they can lead to substantial punitive damages. From miscalculating tax withholdings to missing due dates, errors can activate audits, fines, and dissatisfied workers. Payroll companies concentrate on tax compliance, remaining up to date on federal, state, and local guidelines to ensure precise filings and timely payments.

Enhance Data Security: Payroll data consists of delicate staff member details, such as Social Security numbers and checking account details. Cybersecurity hazards and internal scams dangers make payroll security a leading concern. Professional payroll companies buy advanced encryption, secure cloud storage, and multifactor authentication to keep your business's monetary information safe.

Avoid Payroll Disruptions: If your in-house payroll specialist takes a trip, gets ill, or leaves the company, payroll operations can be tossed into chaos. Outsourcing offers continuity and dependability, ensuring payroll is processed accurately and on time, every time.

Simplify Direct Deposit and Benefits Integration: Many small companies struggle to set up direct deposit or effectively incorporate payroll with benefits administration. Payroll suppliers simplify this procedure, ensuring employees are paid promptly and deductions for benefits like health insurance and retirement strategies are managed correctly.

Scale With Your Business: As your company grows, payroll intricacy increases. More staff members mean more tax obligations, advantage alternatives, and compliance requirements. A payroll service provider can scale with your company, adapting to brand-new challenges without needing you to hire extra HR workers.

The Downsides of Outsourcing Payroll

While outsourcing payroll can save time and minimize administrative concerns, it's not without its challenges. Before devoting to an external supplier, it's vital to weigh the potential drawbacks and figure out whether the compromises align with your company's requirements.

Loss of Control Over Payroll Processes: When you contract out payroll, you give up direct oversight of crucial payroll functions. While automation and devoted payroll professionals can lessen errors, you might have limited exposure into the procedure. If a mistake occurs, such as an incorrect income or a missed tax filing, it might take longer to deal with than if payroll were handled internal. Additionally, you may have to rely on customer support teams with differing levels of responsiveness instead of making immediate modifications yourself.

Data Security Concerns: Outsourcing needs sharing delicate employee info, including Social Security numbers, incomes, and tax information, with a third party. While a lot of payroll suppliers execute robust security procedures, information breaches stay a threat. Additionally, because you do not control their security protocols, you're relying on their capability to protect staff member data. Any lapse in security could lead to identity theft, compliance issues, or financial losses.

Limited Customization and Flexibility: Payroll suppliers generally use standardized services that may not perfectly line up with your business's needs. If your company has distinct payroll structures, such as specific perks, commissions, or industry-specific deductions, adjusting to a third-party system can be challenging. Furthermore, last-minute payroll adjustments, such as including a cost compensation or correcting a tax code, may not be as smooth as they would be with an internal payroll team.

Potential Hidden Costs: While outsourcing can seem affordable, expenditures can build up beyond the base membership charge. Some providers charge extra for year-end tax filings, compliance updates, off-cycle payroll runs, or combination with other organization software application. If your business requires frequent payroll modifications or personalized reporting, these additional expenses can rapidly exceed the initial spending plan. Employee Experience Challenges: When payroll is contracted out, staff members often need to get in touch with a third-party provider for payroll-related questions or problems. This can produce a disconnect, as staff members might fight with impersonal customer support, long haul times, or irregular support quality. Unlike an internal payroll team that comprehends company culture and policies, an outsourced company might not provide the same level of familiarity or responsiveness.

Dependency on Provider Stability: Depending on an external business for payroll indicates your organization is susceptible to its operational stability. If the provider experiences monetary problem, technical failures, or sudden service interruptions, your payroll process might be affected. In severe cases, a provider closing down suddenly might result in lost payroll information and considerable operational headaches.

The Different Kinds Of Payroll Services

Not all payroll outsourcing services are developed equivalent. Businesses have various needs, and payroll companies provide numerous levels of service to accommodate them. Whether you want to hand off everything or maintain some control, there's an outsourcing design that fits your company. Here are the main types of outsourced payroll services:

1. Full-Service Payroll Outsourcing: If you're searching for an entirely hands-off technique, full-service payroll outsourcing is the way to go. This type of supplier deals with every aspect of payroll, including:

- Calculating earnings and deductions;

- Managing tax filings and compliance;

- Administering worker advantages; and

- Handling direct deposits and incomes.

With a full-service provider, all you need to do is provide staff member data, such as hours worked and wage updates. While this choice is the most convenient, it likewise tends to be the most expensive. Plus, companies need a reputable system for sharing precise payroll info on time.

2. Partial Payroll Outsourcing: For organizations that prefer to retain some control over payroll but offload complex tasks, partial outsourcing is a fantastic middle ground. Companies might choose to:

- Manage staff member time tracking and attendance in-house while contracting out tax filing;

direct deposit themselves but outsource compliance and reporting; and

- Keep payroll processing internal however utilize an external service provider for year-end tax return.

This model permits companies to decrease their administrative burden while preserving oversight on crucial payroll functions.

3. Cloud-Based Payroll Services: Cloud-based payroll contracting out offers flexibility and real-time access to payroll data. These services:

- Automate payroll computations and tax filings;

- Allow employees to access pay stubs and tax documents through self-service portals; and

- Integrate with accounting and HR software.

Since cloud payroll solutions are web-based, organizations can handle payroll from anywhere. This option is perfect for remote teams and growing business that need scalability.

4. International Payroll Outsourcing: For companies with an international workforce, worldwide payroll providers simplify the complexities of managing staff members across different nations. These services:

- Ensure compliance with regional tax laws and labor policies;

- Handle multi-currency payroll processing; and

- Manage cross-border payroll tax filings.

Outsourcing worldwide payroll can prevent pricey compliance errors while simplifying payments for abroad employees.

5. DIY Payroll with Provider Support: Some payroll service providers provide a hybrid approach where organizations deal with the majority of payroll jobs however utilize software and tools supplied by the contracting out business. This design is ideal for business that:

- Want to maintain direct control over payroll processing;

- Need automation tools to streamline calculations; and

- Prefer specialist assistance for compliance concerns.

This technique combines the versatility of internal payroll with the security of expert assistance.

How to Choose the Proper Payroll Partner

The best payroll service depends upon your company's size, structure, and requires. If you want a completely trouble-free experience, full-service outsourcing may be the very best choice. If you need flexibility, partial or cloud-based solutions may be a better fit. Here's a list of steps you must consider when selecting the perfect payroll supplier.

Define Your Payroll Needs: Before comparing service providers, summary exactly what you need from a payroll service. Are you searching for full-service payroll that handles whatever, or do you prefer partial payroll contracting out where you maintain control over specific jobs? Consider features like direct deposit, tax filing, benefits administration, and compliance tracking. If your organization runs in several locations or employs remote employees, you might likewise need multistate or worldwide payroll abilities.

Integration with Existing Tools: A smooth payroll procedure depends upon how well your payroll service provider incorporates with your existing systems. Look for services that get in touch with your scheduling software application, HR platforms, and time tracking tools. Proper integration can lower manual data entry, minimize mistakes, and enhance general efficiency.

Compliance and Tax Expertise: Payroll is more than simply paying workers - it involves tax filings, reductions, and compliance with labor laws. A reliable payroll partner need to remain up to date with modifications in tax guidelines and ensure precise reporting to avoid expensive penalties. Ask possible suppliers about their compliance processes and how they manage updates to federal, state, and regional tax laws.

Pricing Structure and Value: Cost is a major factor when selecting a payroll supplier, but the most inexpensive alternative isn't always the very best. Compare rates models, as some companies charge a flat monthly cost, while others costs per pay duration or per worker. Many payroll options, including OnTheClock Payroll, tend to be around $40 monthly and $6 per worker. Be sure to represent any extra costs for tax filings, direct deposits, or HR add-ons. The finest payroll partner uses a balance of cost and worth, saving you time and decreasing payroll-related headaches.

Customer Support and Service Quality: Payroll errors can be demanding, so having access to responsive consumer assistance is necessary. Evaluate the supplier's service options: Do they provide live phone assistance, chat, or e-mail support? Check online reviews and reviews to determine their track record for client service. A payroll partner with strong support can rapidly fix concerns and keep payroll running smoothly.

Security and Data Protection: Payroll data includes delicate staff member information, making security a top priority. Ensure your payroll company utilizes strong encryption, multi-factor authentication, and safe servers to protect against cyber threats. Ask about their data backup policies and how they manage security breaches.

Scalability and Flexibility: Your payroll requirements might evolve as your company grows. Choose a service provider that can scale with you, whether you're including brand-new workers, broadening to several locations, or needing extra features like advantages management or time tracking. A versatile payroll partner will accommodate modifications without needing a significant overhaul of your payroll process.

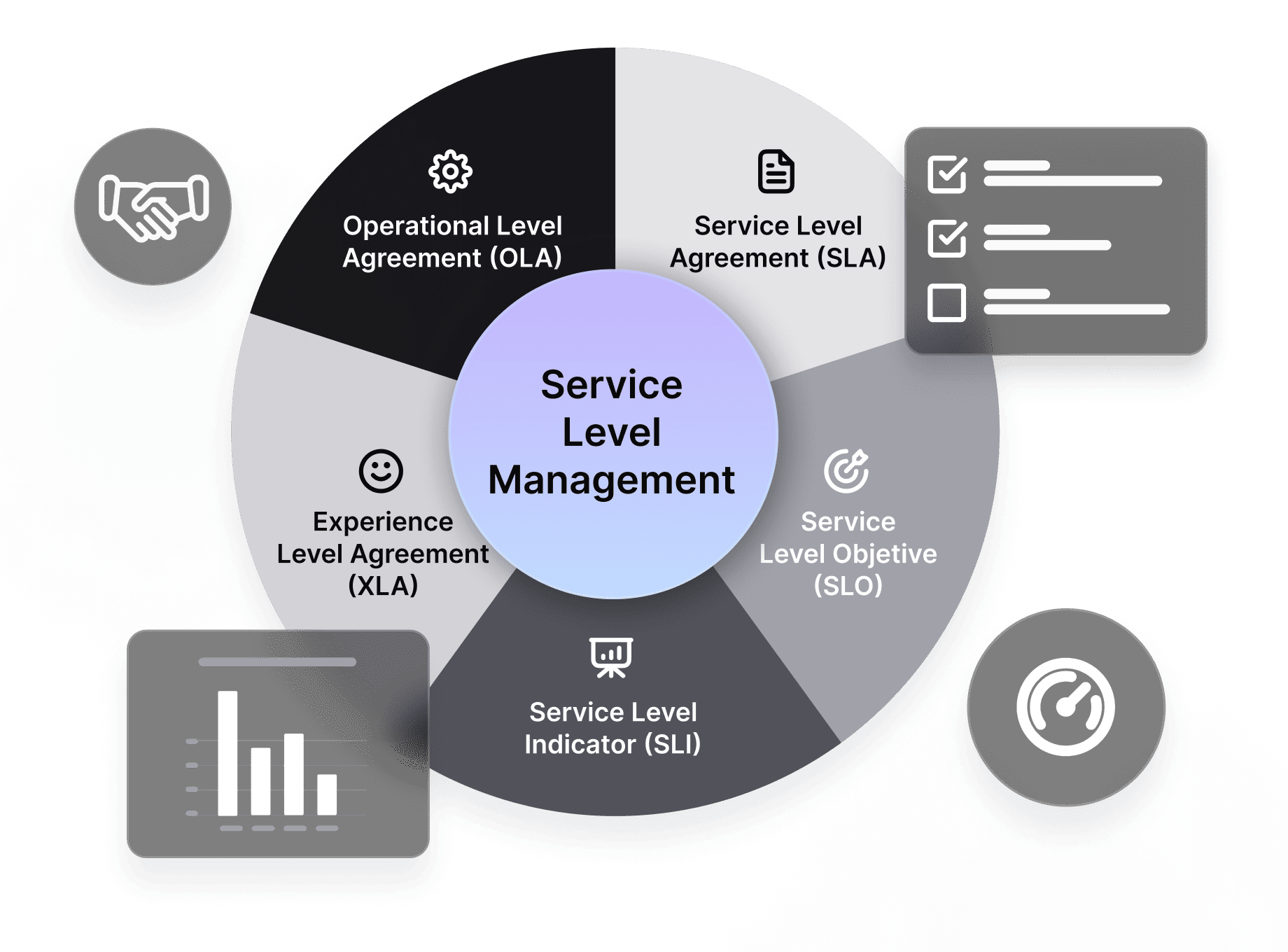

Service Level Agreements (SLAs): A reputable payroll supplier must offer clear service level agreements (SLAs) that outline essential efficiency expectations, such as payroll precision, processing times, and compliance guarantees. These agreements assist ensure responsibility and offer a standard for evaluating service quality.

Reputation and Industry Experience: Finally, research the service provider's track record. Try to find client testimonials, industry certifications, and case research studies that show their knowledge. If possible, pick a payroll partner with experience in your industry, as they'll recognize with sector-specific payroll requirements and compliance challenges.

Outsourcing Payroll: Common Challenges and Best Practices

Outsourcing payroll can be a game-changer for services, lowering administrative work, improving accuracy, and making sure compliance. However, turning over such an important function features its own set of challenges. If not handled correctly, business can deal with interaction breakdowns, security risks, and compliance issues. Below are some common obstacles companies come across when outsourcing payroll and some steps to assist conquer them.

Loss of Control Over Payroll Processes

When you outsource payroll, you give up direct oversight of payroll estimations, tax filings, and worker payments. This can cause issues about openness, accuracy, and responsiveness.

- Choose a supplier that provides real-time reporting and payroll control panels so you can monitor deals.

- Establish clear expectations from the beginning, including due dates, information precision requirements, and escalation procedures.

- Maintain internal payroll competence to review reports and ensure payroll precision.

Communication Breakdowns

A lack of proper interaction in between your company and the payroll service provider can result in errors, hold-ups, and aggravation. Misunderstandings about information submissions, reporting requirements, and staff member classifications can trigger significant interruptions.

- Designate a devoted point of contact on both sides to make sure smooth communication.

- Establish regular check-ins to examine payroll processes, fix problems, and offer updates.

- Use cloud-based payroll platforms that enable real-time access to reports and automated notifications.

Data Security and Privacy Risks

Payroll data contains extremely sensitive employee details, consisting of Social Security numbers, bank details, and income records. A security breach can cause identity theft, monetary fraud, and legal liabilities.

- Work with a company that uses innovative file encryption, multifactor authentication, and safe and secure data storage.

- Limit access to payroll information by defining user roles and approvals within the system.

- Regularly review the company's security policies and need compliance with market requirements like SOC 2 and GDPR.

Compliance and Regulatory Risks

Payroll laws and tax regulations frequently change, and noncompliance can result in large fines and penalties. If your payroll company fails to stay upgraded, your service might be at risk.

- Partner with a service provider that specializes in your industry and is skilled in federal, state, and regional tax laws.

- Request regular compliance audits to guarantee payroll tax filings and staff member classifications are precise.

- Maintain internal oversight by remaining informed about payroll guidelines that affect your organization.

Hidden Fees and Unexpected Costs

Some payroll providers charge extra for services like tax filings, compliance updates, and software upgrades. Without a clear understanding of costs, organizations can deal with spending plan overruns.

- Review the agreement thoroughly before finalizing and clarify all costs, consisting of per-payroll costs, year-end reporting charges, and add-on services.

- Choose a supplier with transparent, all-encompassing pricing to prevent unanticipated costs.

- Regularly evaluate whether the payroll service is economical for your organization.

Integration Challenges

If your payroll service provider's system does not integrate efficiently with your existing accounting, HR, or time tracking software application, it can lead to inefficiencies and manual information entry mistakes.

How to Overcome It

- Select a supplier that provides smooth integration with your existing tools, such as QuickBooks or OnTheClock.

- Test the combination before completely transitioning to outsourced payroll to identify potential concerns.

- Work closely with your provider to tailor data exports and imports for accuracy and efficiency.

Final Thoughts

Lisa's story is all too familiar to many business owners and office supervisors. Payroll mistakes, compliance worries, and consistent interruptions can turn payday into a source of tension rather of an easy procedure. By outsourcing payroll, Lisa took control of her time, lowered errors, and guaranteed her group was paid properly and on time.

If payroll has become a burden for your service, it may be time to explore a much better solution. OnTheClock Payroll streamlines the procedure, so you can focus on running your service - not stressing over paychecks. Ready to simplify payroll? Try OnTheClock Payroll today and let us manage the heavy lifting so that you can concentrate on what matters most: growing your service!

- 이전글Outsourcing Payroll: all you Need To Know 25.04.23

- 다음글20 Best Enterprise Payroll Software In 2025 25.04.18